Ken Lopez

Ken Lopez

Founder/CEO

A2L Consulting

This is the fifth consecutive year that I've written a new year economic outlook article focused on litigation. Please review some of my previous articles that were focused on 2016, 2015, 2014, and 2013. While I believe that 2017 will be a very good year for litigation, it will not be good for everyone. From where I sit, things look and sound remarkably different during this current economic expansion than they did in previous years.

A2L's litigation consulting business, one focused almost entirely on trials, is thriving. We've grown more than 50% in each of the past two years, and I'm forecasting similar or better growth for 2017. Our growth is spread across many law firms/corporations and many areas of the law, so I know it's meaningful growth.

Yet any conversation with my large law firm managing partner friends or my big company in-house counsel friends suggests that litigation should be having an off year. These well-informed sources, as well as courthouse data, tell me that case filings are down and that litigation at big law firms is down.

So, how can our trial-driven firm be prospering and big litigation departments be faltering? One of us has to be looking at the litigation industry all wrong, right?

Actually, I believe that we're both right, and I'm trying on some new vocabulary to explain it.

I've long observed that litigation is closely tied to economic growth. It's simple logic. Big companies drive both the economy and big-ticket litigation. When one moves up or down, so does the other, quite reliably.

After more than 21 years as one of the leading litigation support companies largely focused on big-ticket litigation, I (finally) realize there is a more nuanced way of looking at litigation and trials. I used to think litigation was either small-ticket or big-ticket, and A2L is focused mostly on the latter. But now, after going through a few periods of robust economic growth (the early and mid-2000s and the current market), I understand that there's actually a third type of litigation. For now, I'm calling it resolvable big-ticket litigation.

By “resolvable big-ticket litigation,” I'm referring to those large cases with between tens of millions and billions of dollars at stake that could be settled if the parties were truly motivated to do so. Everyday big-ticket litigation is distinguishable from resolvable big-ticket litigation since in the former type, there just isn’t a good settlement position. Perhaps it's a patent dispute where there is no reasonable licensing compromise, or an antitrust case where the merger is either going to be approved or blocked, or one of those cases where what’s at stake is a principle, not money.

What I notice about resolvable big-ticket litigation is how highly sensitive it is to economic fluctuations. Yes, all big-ticket litigation rises and falls with economic conditions. But resolvable big-ticket litigation is very sensitive to it. Economists would say it is highly elastic; if there is a small increase in the rate of economic growth, resolvable big-ticket litigation skyrockets. Of course, the opposite is true too. When the economy dips or economic uncertainty is introduced, those resolvable cases are in fact resolved because companies stop gambling or at the very least, they take some risk off the table.

The last year I saw resolvable big-ticket litigation performing as well as it is now was 2005. I expect current levels to continue through 2017 at least, and here's why.

Big-ticket litigation generally, and certainly resolvable big-ticket litigation, is highly correlated with the economy, and leading indicators that reliably predict economic growth six to nine months in the future are soaring.

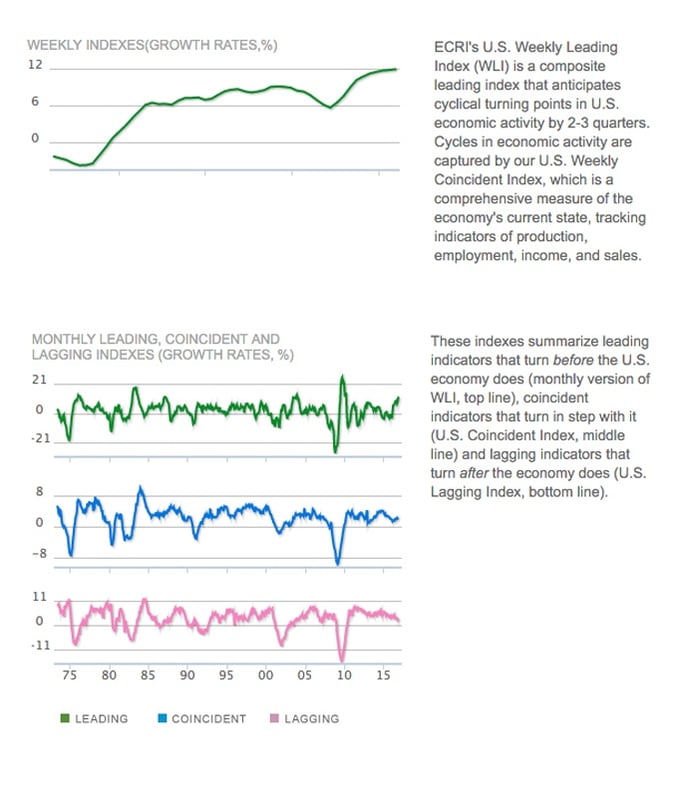

Take a look here at the latest report of ECRI, the Economic Cycle Research Institute or simply look at these charts below.

If you read annual articles of mine in the past, you know that I put enormous faith in the work of ECRI. They publish these straightforward leading indicators, and notably they have been on the rise for the last year and they are currently reaching levels we have not seen in a decade.

If you read annual articles of mine in the past, you know that I put enormous faith in the work of ECRI. They publish these straightforward leading indicators, and notably they have been on the rise for the last year and they are currently reaching levels we have not seen in a decade.

In both the weekly chart and the monthly charts above, the green line reflects a prediction of what will happen in six to nine months based on very reliable data. If it's going up, it's good because it means growth is coming. Down means growth is slowing.

Under the weekly chart, there is a monthly chart looking at the past 40 years. Look only at the green line, and you'll see the historic levels the growth rate leading indicator is approaching. If you want to learn more about this forecasting tool, I recommend the book Beating the Business Cycle.

With this level of economic growth setting up, I'm expecting another great year of trials of all types. However, if resolvable big-ticket litigation is the type that really skyrockets in boom times, I'm also looking for more of that this year.

So, while there are in fact fewer trials than there used to be, resolvable big-ticket litigation appears to be on the rise. For the typical large law firm, this means fewer cases but a higher proportion of trials. For a company like ours, these are boom times. The biggest risk for our firm and the entire litigation industry is whether uncertainty generated by the change in the administration causes large companies to pull back on their litigation spend or take fewer risks at trial. Time will tell, but the leading indicators do not suggest a pullback—yet.

Articles related to the economics of the litigation market, law firm sales, pricing and more on A2L Consulting's site:

- The Litigation and Economic Outlook for 2016

- Three Top Trial Lawyers Tell Us Why Storytelling Is So Important

- 2015 Economic Forecast for the Litigation & Litigation Support Markets

- [Free Download] How to Get Value from Litigation Support Firms in The New Normal Legal Economy

- 2 Metrics Showing Litigation Shifting to Midsize Law Firms

- 17 Tips for Great Preferred Vendor Programs

- 12 Alternative Fee Arrangements We Use and You Could Too

- Headed to trial, IPR, hearing, or ADR in 2017? Please help us not get conflicted out!

Leave a Comment