We have have created courtroom presentations in banking cases almost since our very beginning nearly 17 years ago. From savings and loan litigation in the 1990s to IPO litigation stemming from the 2001 dotcom meltdown to ongoing banking fraud and bankruptcy litigation connected with the 2008 financial crisis, we have helped jurors understand complicated financial concepts that are at the heart of most banking litigation.

We have discussed earlier this year how a good trial consultant can make complex financial concepts comprehensible to jurors by using courtroom presentations that relate to a juror’s basic understanding of life and personal experience. See our discussions of collateralized debt obligations and of securities litigation.

The same can apply to courtroom presentations for seemingly complex banking litigation. Since nearly all jurors have bank accounts and have used ATM’s, they have a basic sense of what banks do. So it often is not a long stretch for them to have an intuitive notion that banks are involved in complex ATM networks, that they sell profitable investment products to clients, or that they manage and move large sums of money. What is more difficult is explaining the details of how these things work.

In a straightforward courtroom presentation graphic below, we showed that the total revenue of a bank far exceeded the gross national product of Guatemala. We used a supermarket scale and money bags – a basic concept that any juror can follow – to make an indelible impression on the jurors.

In another very straightforward courtroom presentation graphic, we showed people sitting around a conference table as a partner in a major accounting firm told them about a highly questionable tax shelter that the firm was marketing. The “shady characters” are shown in shadow to emphasize the dubious nature of what they are doing.

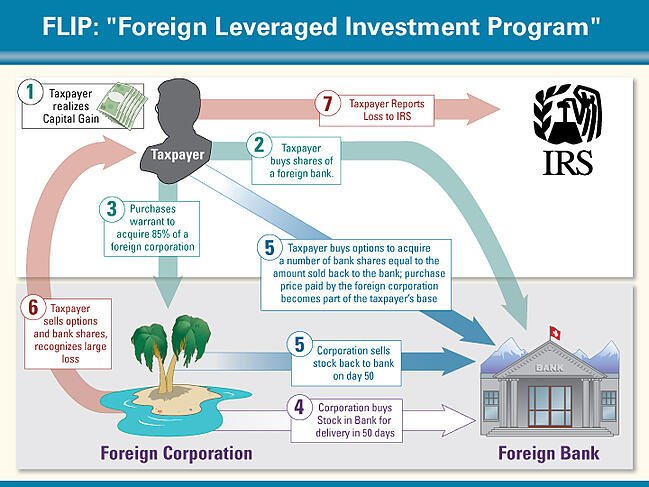

In another courtroom presentation illustration for the same case, we portrayed this complicated financial transaction with an illustrated flow chart with seven steps, beginning with “Taxpayer realized Capital Gain” and ending with “Taxpayer Reports Loss to IRS.” Even if a juror does not fully understand the transaction on the same level as those who devised it, he or she certainly understands that somehow a “Capital Gain” was transformed into a “Loss” for the IRS. The juror has paid taxes and has never been able to convert a gain into a loss, we can be assured.

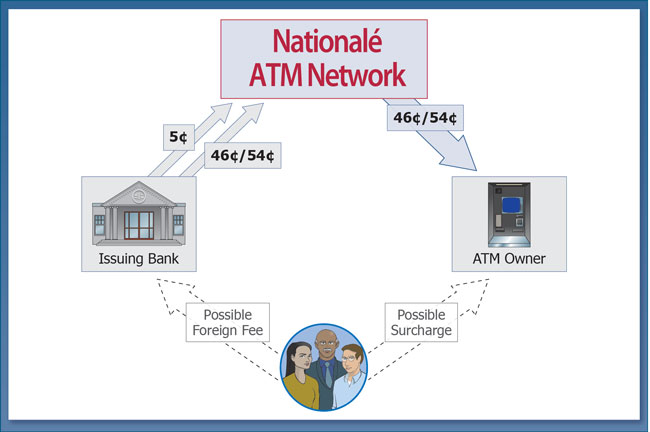

We also graphically portrayed how a worldwide ATM network functions. At the bottom of the courtroom presentation chart are the individual bank customers, who are faced with the possibility of paying a “foreign fee” and a “surcharge.”

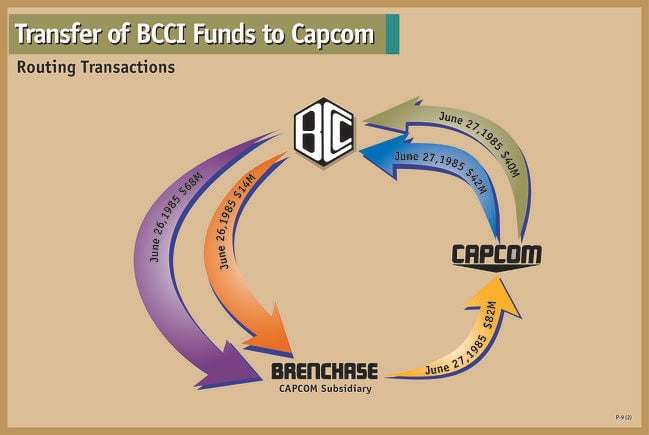

Finally, for litigation involving the BCCI bank scandal of the 1980s, we created a similar chart that showed the flow of money from various entities in that case to BCCI. This case represented our first billion dollar win. We've had hundreds since.

Leave a Comment