by Ken Lopez

by Ken Lopez

Founder/CEO

A2L Consulting

Over the past couple of Decembers I've written articles offering an economic forecast for the coming year with a focus on litigation. These writings serve both to spread useful information to the legal industry and to help me to plan A2L's budget for the coming year. I thought a mid-year update might be valuable in these challenging economic times.

One might reasonably ask, if the focus is litigation, why would one look at the economy as a whole? First, there is no reliable litigation spending index that I am aware of, and second, my observation is that big-ticket civil litigation largely tracks the economy. When the economy is growing, litigation spending goes up. When the economy is shrinking or there is economic uncertainty (e.g. terrorist threats, massive changes to entitlement programs, election years etc.), cases settle and litigation spending shrinks.

While there are plenty of exceptions, many of A2L clients are large law firms with large corporations as customers. Large corporations are especially reactive to economic shifts. Indeed, for the most part, they are the economy, with Fortune 500 revenues now roughly equal to 78% of U.S. Gross Domestic Product (important note: not all of these revenues count toward U.S. GDP, such as overseas sales, so the actual percentage of GDP is much lower).

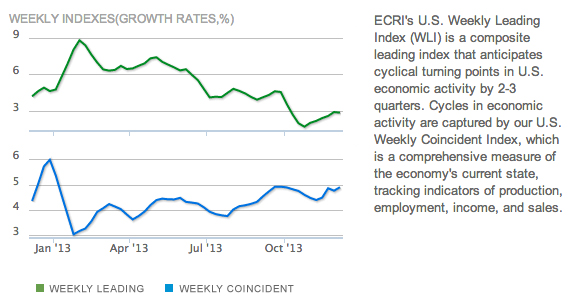

For the past 10 years, I've been watching one composite leading indicator from ECRI that does an excellent job of predicting the economy 6-9 months in the future. Last December, I observed that the U.S. economy was generally in a downtrend and that 2014 would look a lot like 2013 for litigation. That's largely held true unfortunately, and the economic news out today showing a massive Q1 contraction (revised way downward) is simply shocking. Perhaps though, there is a bit to be optimistic about.

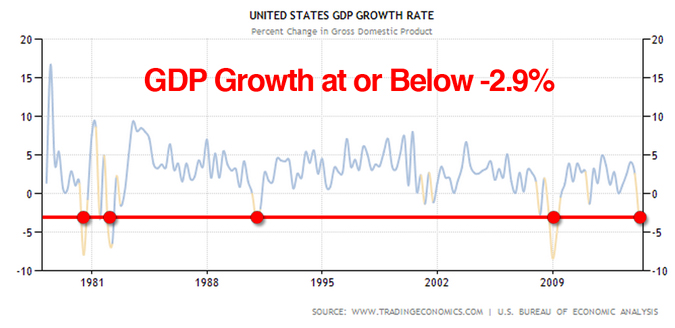

Looking first at the bad news, in the first quarter (last quarter), we all saw the economy shrink by a historic 2.9%. To put that into perspective, look at the chart below to see the last few points in time we saw a contraction at or worse than today's level.

That's right. The first quarter of 2014 is similar to points in 2009, 1991, 1983 and 1981. Yikes. That's pretty bad. To make matters worse, both the Federal Reserve and the Congressional Budget Office are forecasting painfully lackluster growth in the 2% range for the foreseeable future.

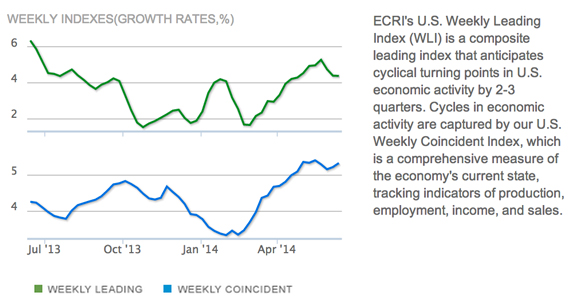

The only bright spots I am seeing are a meaningful uptick in the leading indicators and anecdotal evidence that our litigation practice is busy and looks to be setting up for an even busier 2015. We already have quite a number of mock trials being scheduled in 2014 for 2015 trials. Looking at the charts below, you can begin to see the difference between December's outlook and today's outlook. To quickly understand the charts, know that the green line represents a forecast about 8 months in the future from the date below any point. The blue line represents what actually happened at a given point in time in the economy. Even more simply, up is good, down is bad.

Last December 2013:

Now (June 2014)

The takeaway from the leading indicators here is this: In December of 2013, a downturn was forecast to continue (green line, upper chart). That downturn is reflected in the blue line in the lower chart stretching from October 2013 to March 2014. A modest uptick is forecast (green line, lower chart) that appears to run from roughly May 2014 through at least the end of the year. Let's hope that picks up steam.

For litigation, I would say things look slightly better than a year ago and much better than they did six months ago. The Q2 GDP number will be one to watch after it is revised a couple of times. I'm sure it will come out positive initially (they always seem to lately). The question will be whether it is revised to be negative later this year. If so, we would have two consecutive quarters of negative growth - an official recession. If that happens, you can bet Fortune 500s will cut back. They'll likely cut back on litigation modestly based on the Q1 number and wait for good news. If Q2 comes in negative, litigation spending cuts will likely get even deeper.

Articles related to the economics of the litigation market, law firm sales, pricing and more on A2L Consulting's site:

- 2014 Economic Forecast for the Litigation & Litigation Support Markets

- [Free Download] How to Get Value from Litigation Support Firms in The New Normal Legal Economy

- 2 Metrics Showing Litigation Shifting to Midsize Law Firms

- 8 Reasons to be Optimistic About the Litigation Economy

- 17 Tips for Great Preferred Vendor Programs

- 12 Alternative Fee Arrangements We Use and You Could Too

- Improving Economy Predicted to Bring More and Different Litigation

- 2013: a Good Year for Litigators and Litigation Support Consultants?

Leave a Comment